Table of Contents

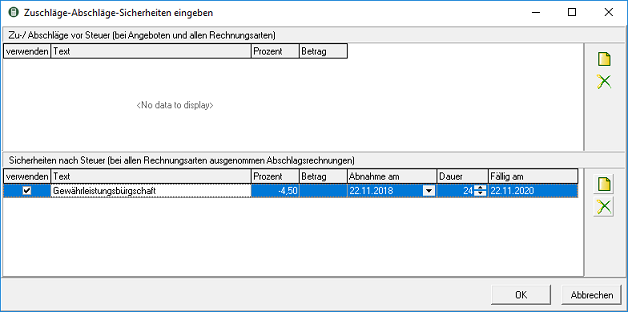

Surcharges-discounts-securities

Description

For the printout of an invoice / credit note, the surcharges / discounts, deductions and securities that are stored for the LV are taken into account. Before printing the invoice, you can check these settings in the print menu and edit them if necessary.

Application

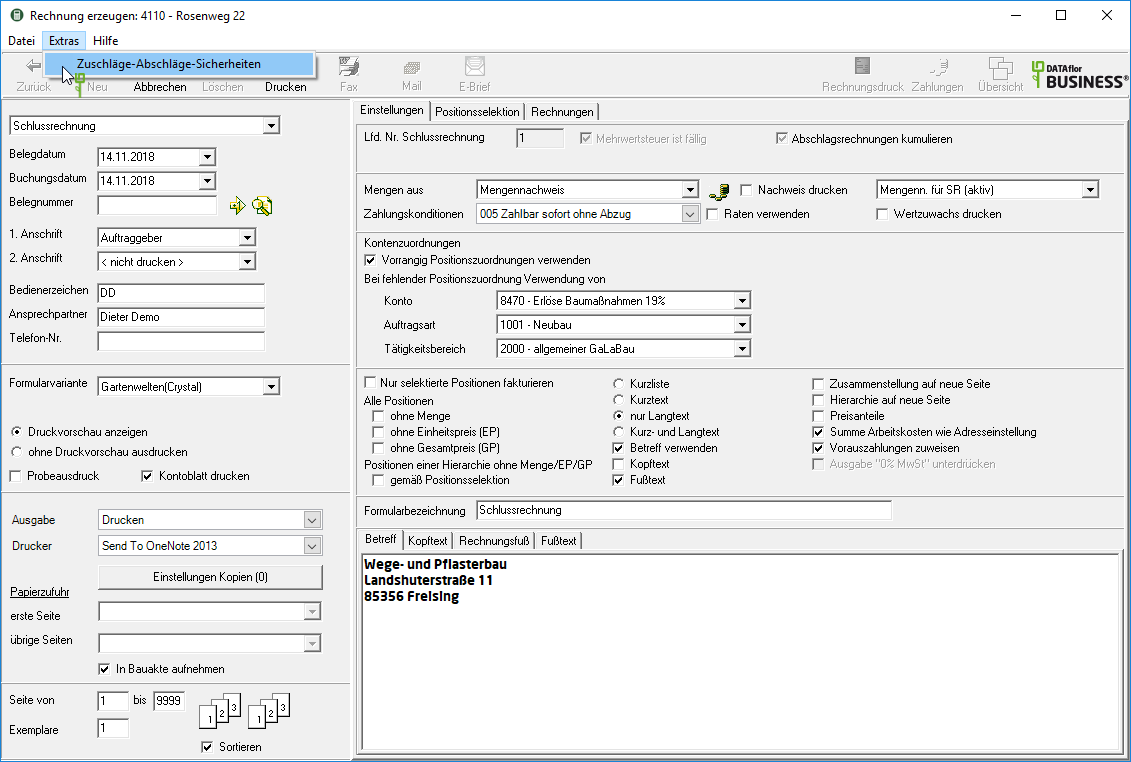

Open in Invoice printing the item in the menu bar Extras and select the entry Surcharges-discounts-securities.

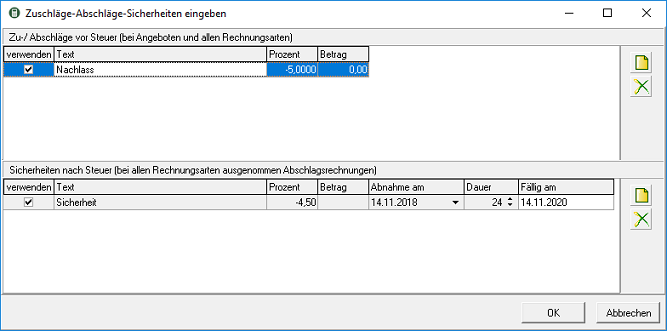

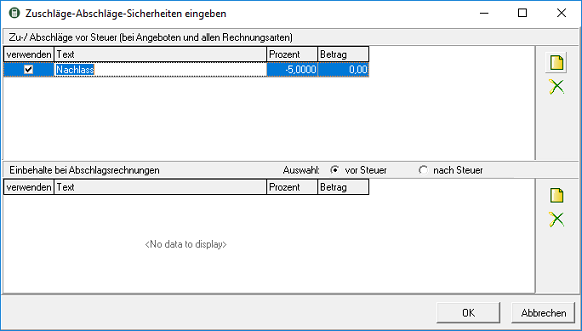

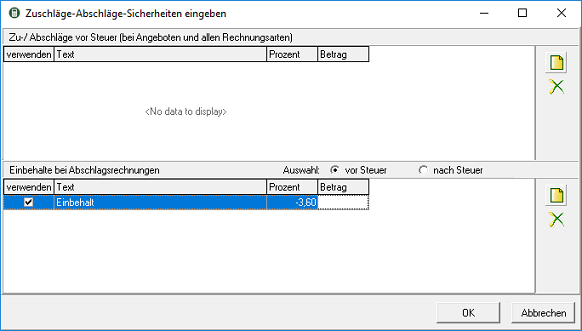

The dialogue Enter surcharges-discounts-securities will be opened.

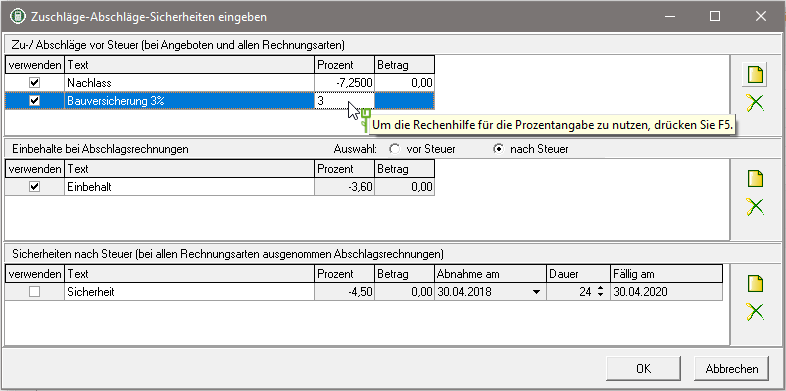

- Depending on the selected invoice type, surcharges / discounts, withholding and / or securities can be defined. The data that you have stored for the course are pre-entered.

- If there are entries, the dialog is automatically opened for checking purposes before the print preview is opened.

LV surcharge / discount

single-level LV surcharge / discount

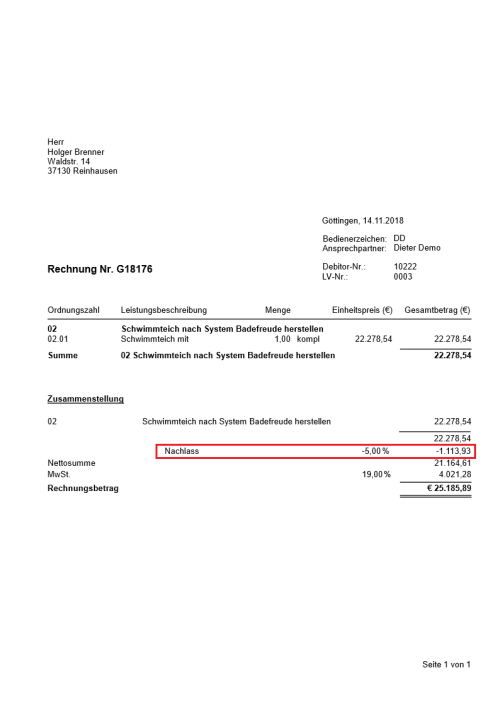

Surcharges or discounts, which are calculated on the total of the selected items, can be defined for each invoice type and credit memos.

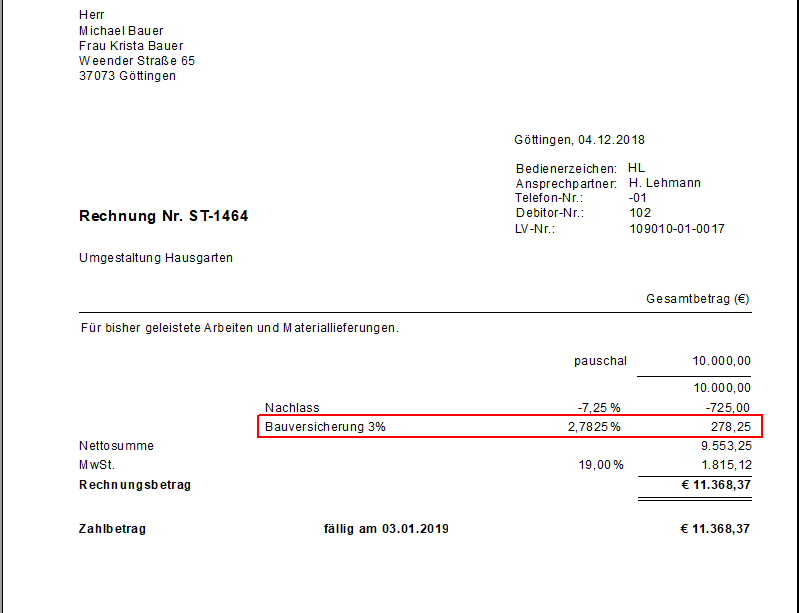

- The label that you put in the column text will be printed on the invoice.

- Percentage surcharges / discounts (column percent) and a fixed amount (column amount) can be set as a surcharge or discount.

- Positive percentages or amounts are added to the invoice amount (surcharge), negative percentages or amounts are deducted (deduction).

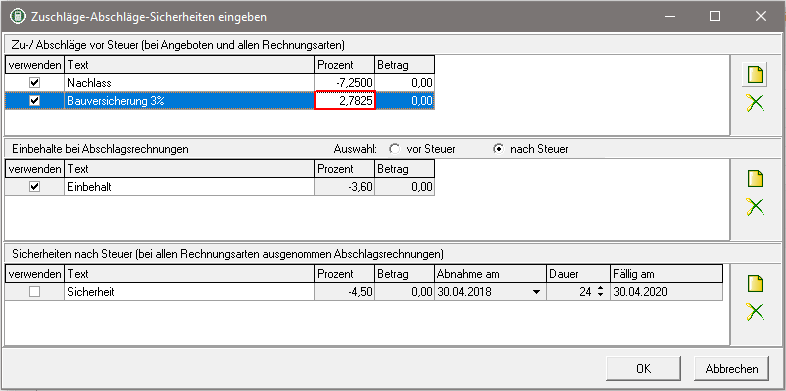

two-tier LV surcharge / discount

On the sum that results from the surcharge or reduction of a single-level LV surcharge / discount, a percentage LV surcharge / discount can be calculated, e.g. for calculating construction insurance.

First enter the first LV surcharge / discount, which will be calculated on the total of all items. Then create a second surcharge / discount, enter the agreed percentage and press the button F5.

The percentage value is "converted" into the percentage value that results from a surcharge / discount on the sum of all items. This is also used to print out the invoice. If you add the agreed percentage value in the description of the LV surcharge / discount, the invoice recipient can see how the amount is calculated.

Calculation example:

LV total minus 7,25% discount = € 10.000,00 - € 725,00 = € 9.275,00

3% construction insurance = € 9.275,00 * 3,00% = € 278,25

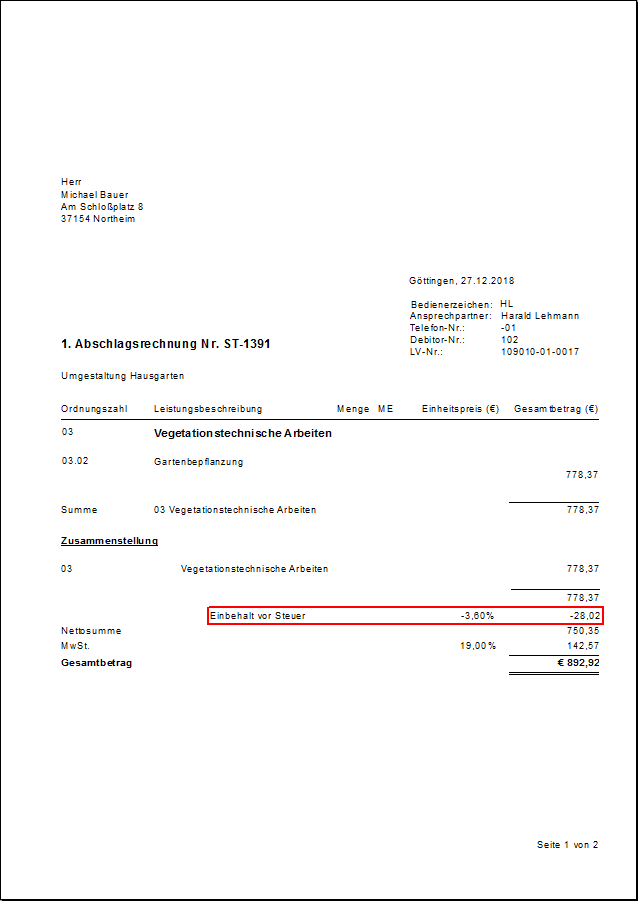

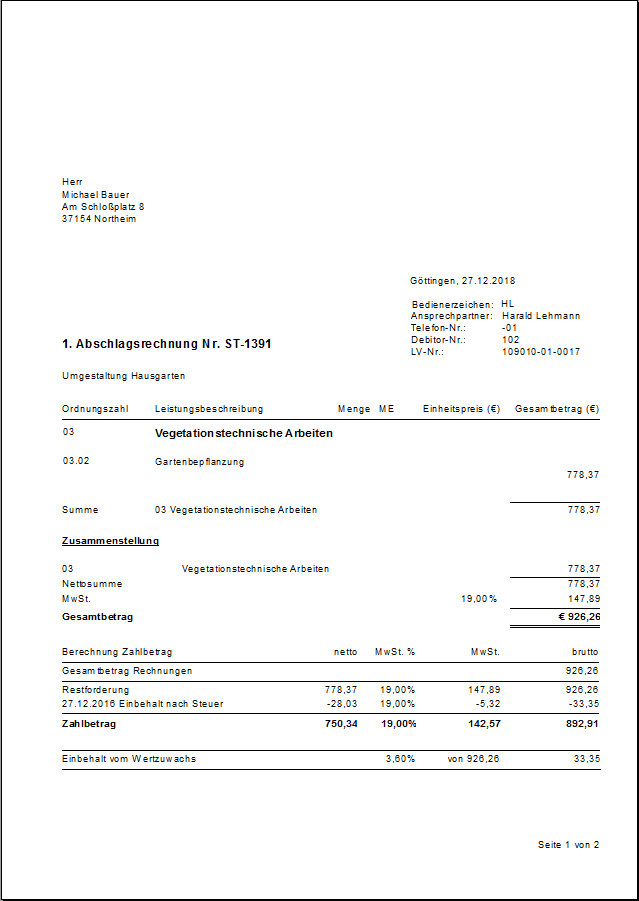

Retention

Retentions are only used for partial invoices and are im Invoice printing only displayed if this invoice type is selected.

- The label that you put in the column text will be printed on the partial invoice.

- A percentage value (column percent) or a fixed amount (column amount) To be defined.

- The retention can optionally be deducted from the net amount (option before tax) or the gross amount (option after tax) subtracted from.

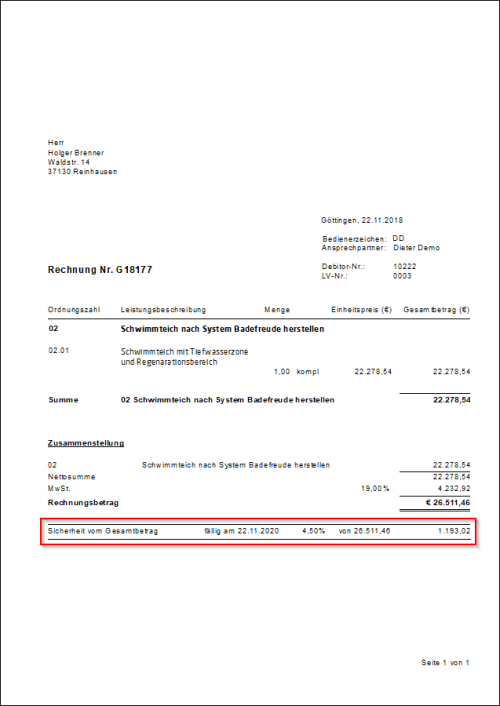

Safety

Collateral is only used for invoices, partial final invoices and final invoices and is included in the Invoice printing only displayed if one of these invoice types is selected.

- The label that you put in the column text is for your information.

- A percentage value (column percent) or a fixed amount (column amount) To be defined.

- As the acceptance date (column Decrease on) the current system date is preset by default and can be changed individually.

- For the Duration The default security is set to 24 months and can be changed individually.

- From Decrease on and Duration the due date (column Due on) calculated.