Table of Contents

Show labor costs

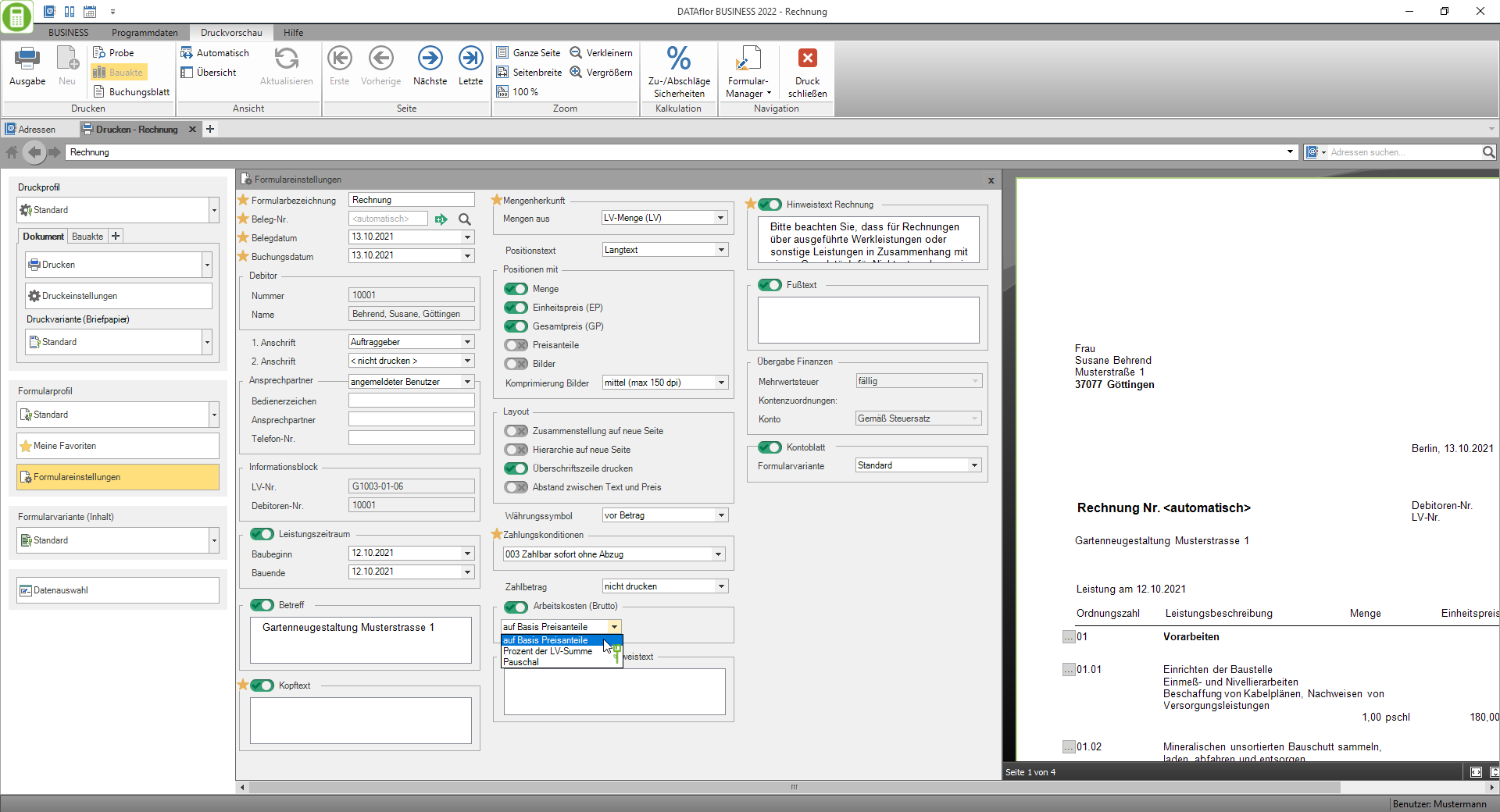

Description

For private customers there is the possibility of claiming the labor costs (including wages, travel expenses, consumables, equipment hours) of household-related services and craftsmen's services in the personal income tax return in accordance with Section 35a of the Income Tax Act. Corporate Customers In accordance with Section 140 of Book IX of the Social Code, workshops for handicapped people can partially offset the labor costs against the equalization charges to be paid.

On LV printing and Invoice / credit choose the basis on which labor costs are reported.

| On the basis of price shares | Before doing this, specify in the basic data of the course which price shares are to be used as beneficiary portion (Labor costs). The labor costs are shown with the set surcharge rates. |

| Percent of the LV total | The labor costs are determined from the entered percentage of the LV total. |

| flat-rate | Enter the lump sum in net. For printouts on which the gross labor costs are shown, the conversion takes place automatically. |

- The labor costs are shown with a discount, if applicable.

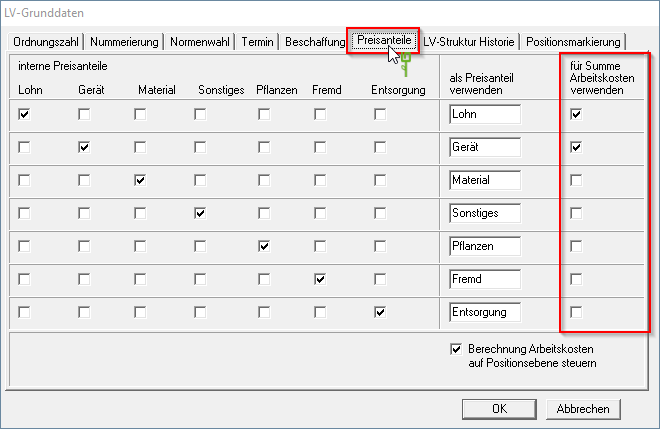

Assign price shares

The allocation of the internal price shares to the price shares for labor costs takes place in the Course basic data. On the tab Price shares in the column use for total labor costs start with the price shares  , from which the sum of the labor costs is formed for this LV.

, from which the sum of the labor costs is formed for this LV.

If there is no division into price shares for an item, the entire unit price is shown as the beneficiary share for the labor costs.

Assign positions

You also have the option of single positions not to be included in the total of the beneficiary share. This is important because according to §35 EStG, for example, snow clearing carried out on public areas is not deductible.

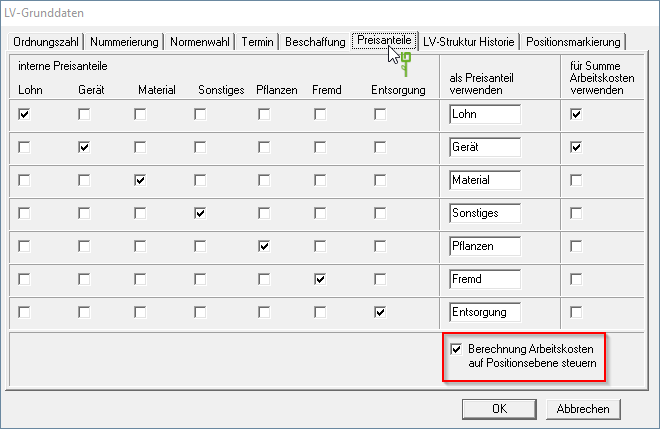

To do this, put in the Course basic data the option Calculation control labor costs at item level aktiv  .

.

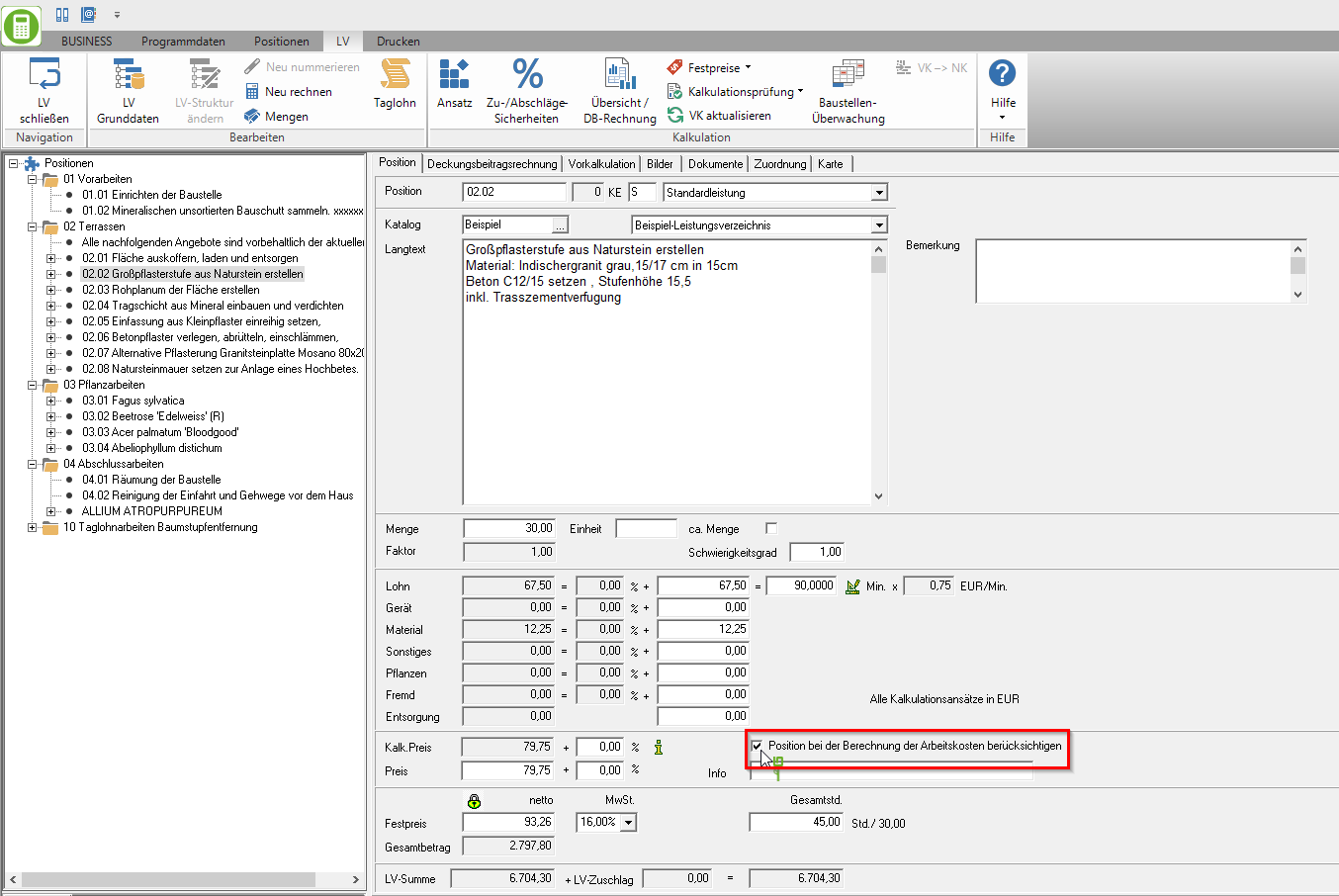

Then you decide for each Position whether or not this is taken into account for labor costs. Activate  To do this, go to the position on the tab Position the option Take position into account when calculating labor costs.

To do this, go to the position on the tab Position the option Take position into account when calculating labor costs.

If the labor costs are printed on the printout, the option Price shares the price shares are only printed for the items that are taken into account for the calculation of the labor costs. In this way, it can be seen on the printout from which items the labor costs are made up.

Print labor costs

In order to show the labor costs in the printout, activate the form group for the LV printouts in the print management Print out business transactions (Fast) (e.g. offer, invoice) the form setting labour costs.

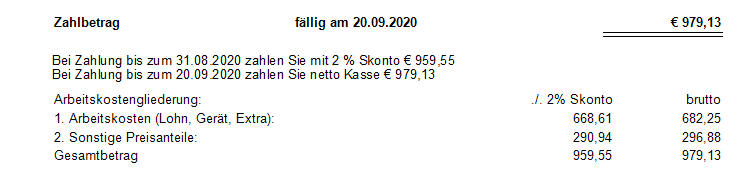

For example: Invoice printing

- In the Address of the client.

- If, as a rule, no labor costs are to be reported for the client, specify in the labour costs of the client in the selection labour costs the entry do not push so that the form setting is deactivated by default in print management.

- For LVs that are created with a tax rate of 0,00% according to §13b UStG, the labor costs are always shown net on the LV printouts and invoices.

Example expression: Invoice with discount, gross labor costs